Social Inflation has factors that can influence it to be higher or lower at various times, but the fact is that it exists and its effects are being felt across the insurance industry. Let us start by clarifying what Social Inflation is.

No matter the type of insurance you specialize in or the offers your company has available, you have probably heard the term ‘social inflation.’ Although many do not believe in it and call it ‘the insurers way to raise the cost of premiums,’ social inflation is a very real, serious, and expensive problem.

What is social inflation?

According to the Geneva Association in their 2020 report on the subject of Social Inflation, a broad definition of this topic is “all ways in which insurers claims costs rise over and above general economic inflation, including shifts in societal preferences over who is best placed to absorb risk. More narrowly defined, refers to legislative and litigation developments which impact insurers’ legal liabilities and claims costs.”

As can be seen in this definition, Social Inflation refers to a fleeing subject which is the so called “social climate” in which concepts like trust, confidence, the media, and so on, play the most important.

A Deep Problem

Social Inflation is not something new that we have seen in the last few years, it has been appearing in waves since the 80’s, and as stated, has a lot to do with social climate, which is not something that is easily measured.

According to the Geneva association in their report, they suggest they started seeing the effects again after the fiscal crisis of 2008 but skyrocketed in 2020 because of the COVID-19 pandemic. “It tends to occur in bouts or waves and respond to episodic shifts in the liability landscape. Sometimes these can be triggered by single, high-profile events.” remarks the Geneva Association.

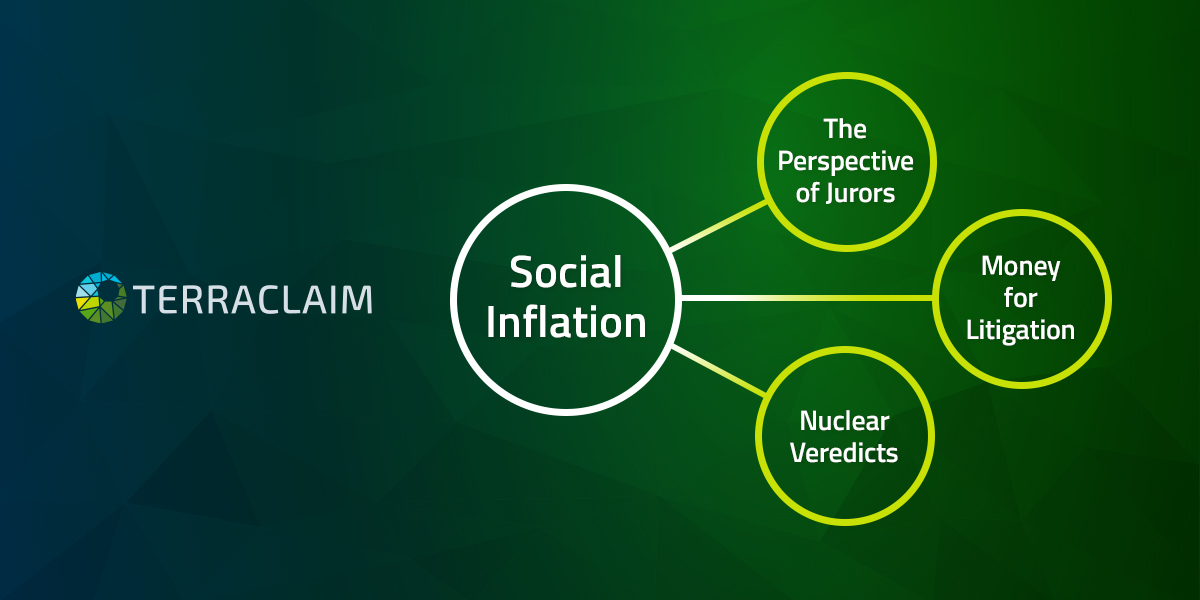

Social Inflation can be attributed to 3 main causes.

- The perspective of jurors: A big driver for social inflation comes from the 2008fiscal crisis, which brought a big an anti-corporate sentiment. That stayed with jurors and extended into their verdicts, which started a tendency towards plaintiffs winning litigation against companies in the name of social justice. They seem to be holding big companies responsible for their actions, thus making ‘a statement.’

- Money for litigation: Claimants started to receive help from outside investors for taking their cases to court. They pay legal fees and expenses for a portion of the settlements. Settlements are not encouraged because it is more profitable to keep litigation going. As a result, investors buy risks to keep litigation going and thus make more money of premiums.

- Nuclear verdicts: The big anti corporate sentiment translated into record braking caps on punitive damages.

There are other factors to be considered when dealing with this complex subject.

- Liberal treatment of claims.

- Changing views of social responsibility and the righting of wrongs.

- Populism.

- Society’s desensitization to large jury verdicts and settlements.

As it can be seen, Social Inflation is a deep and complex subject which depends a lot on social perceptions of right, wrong, and what constitutes damage plus the people who make the laws and the jurors and the social climate.

Of course, a rise in premiums can only hurt the industry in this case, because these are not costs that can be translated to actual benefits. These are the result of mistrust in the judicial system, in the insurance industry, and in corporate America as a whole. As a result of this, as an insurer, broker, or administrator you must be asking yourself.

“Against this backdrop, insurers should be proactive: strengthen their claims management processes, focus on better understanding and measuring liability exposures – as rigorously as they do in property – and develop new products and risk-absorbing mechanisms.” – Jad Ariss

Is there anything that can be done against social inflation?

“Against this backdrop, insurers should be proactive: strengthen their claims management processes, focus on better understanding and measuring liability exposures – as rigorously as they do in property – and develop new products and risk-absorbing mechanisms.” Said, Jad Ariss Managing Director of The Geneva Association

Therefore, following his example, it can be said that as an insurer you should:

- Improve your claim management process: this can be easily done by acquiring a claim management software.

- Understand and measure risks in a different way: active risk management proves that being aware and willing to manage risks as they appear, may decrease the chances of those risks materializing. Thus, insurers make sure they are doing everything they can to avoid problems like litigation.

- Build a trusting relationship with brokers: trust between risk managers and brokers is paramount when looking for insurance coverage, especially when navigating a challenging market.

- Be organized going into renewal: pandemic or not, risk managers still need to be organized. This approach means having complete submissions, ensuring compliance with outstanding loss control recommendations, and starting the process early.

- Emphasize active safety and quality control: the best way to get optimal pricing is to have a robust, active safety and quality control program.

- Educate your policyholder and manage expectations.

- Understand the market: develop long-term relationships with insurers that are comfortable with your client’s business at a reasonable premium with reasonable terms and conditions.

- Understand what is driving up loss costs: Avoid risks with poor risk profiles relative to the premium.

- Make sure that your policyholders have above-average loss control for both their property and liability exposures.

An Insurance Claim Software for Insurers Brokers and Risk Managers

When it is said that a managing software could be a good response against the dreaded social inflation phenomenon, TerraClaim should be your go-to solution. It can handle claim management, centralized claim data, analytics on your business, and create reports. You can schedule a demo here to see it in action for yourself.