The Need for a Unified Workers’ Compensation Solution

The workers’ compensation industry is facing unprecedented challenges. Insurers and claims adjusters are juggling complex claims processing, regulatory compliance, and policy administration—often using disconnected systems that slow down operations. With rising claim volumes, compliance risks, and increasing customer expectations, insurers need a centralized platform that integrates claims management, policy administration, and data exchange. Many are already digitalizing claims management to cut costs and boost efficiency.

In this blog, we’ll explore:

✅ Why traditional systems fail to keep up with modern insurance demands.

✅ The benefits of an integrated approach to claims, policy, and compliance management.

✅ Real-world success stories showcasing the impact of unified insurance technology.

The Challenge: Why Legacy Insurance Systems Are Holding You Back

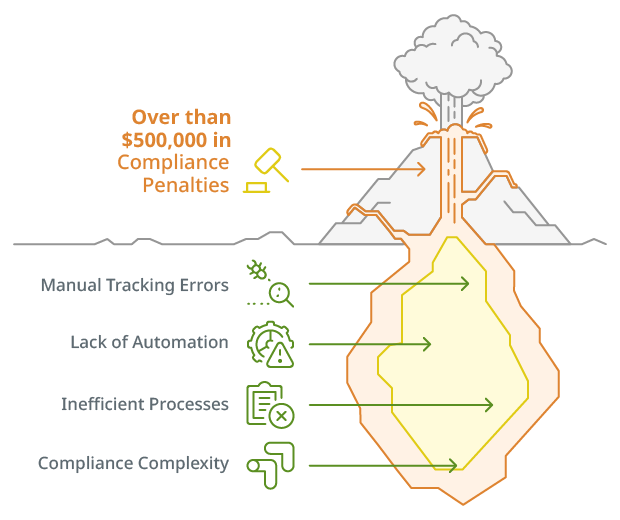

Many insurers operate with fragmented systems for claims processing, policy administration, and regulatory reporting. These disconnected workflows create several operational bottlenecks.

Inefficiencies in Claims Management

- Manual data entry leads to delays and errors in processing claims. Exploring the benefits of cloud technology in claims management can provide deeper insights into how automation tackles these issues.

- Adjusters waste time switching between different platforms instead of focusing on case resolution.

- Lack of real-time insights makes it difficult to track claim status effectively.

Complexity in Policy Administration

- Policy issuance and renewals require repetitive manual tasks that slow operations.

- Regulatory compliance varies by state, increasing the risk of non-compliance penalties.

- Policyholder data is often stored in separate systems, making updates difficult.

Compliance Risks & Data Silos

- Many insurers struggle with state-mandated reporting requirements due to outdated processes.

- Without proper integration, insurers fail to meet SOC 2-compliance standards for data security.

A mid-sized workers’ comp insurer lost over $500,000 in penalties in one year due to late compliance filings caused by manual tracking errors.

The Solution: An Integrated Workers’ Compensation Platform

A centralized platform that combines claims management, policy administration, and compliance automation allows insurers to streamline workflows, reduce costs, and ensure regulatory compliance. This unified approach is akin to transforming workers’ compensation management with integration, where various systems work in concert.

1. Automated Claims Management

-

-

- AI-powered claims intake: Automatically capture and validate claim data, reducing adjuster workload.

- Workflow automation: Assign claims based on severity and adjuster availability for faster resolution.

- Integrated fraud detection: Leverage AI to identify fraudulent claims in real-time.

-

A leading insurer reduced claim resolution times by 40% by integrating claims intake automation and real-time adjuster dashboards.

2. Streamlined Policy Administration

-

-

- End-to-end policy lifecycle management: Automate issuance, renewals, and amendments.

- Regulatory compliance tracking: Ensure all policies meet state-specific requirements with built-in compliance automation.

- Policyholder self-service portals: Improve customer satisfaction by giving clients instant access to policy updates.

-

After implementing a policy automation solution, an insurer saw a 50% decrease in policy processing times, resulting in higher customer retention rates.

3. Seamless Integration with Compliance & Third-Party Systems

-

-

- State-mandated reporting automation: Ensure timely and accurate submissions to regulatory bodies.

- API-driven data exchange: Connect with payroll, legal, and healthcare providers to eliminate manual data entry.

- SOC 2-compliant security standards: Protect sensitive policyholder and claims data.

-

A national carrier reduced compliance-related errors by 45% after adopting a unified system with automated state filings.

Key Benefits of a Unified Workers’ Compensation Platform

-

-

- Faster Claims Processing

Eliminates manual bottlenecks and reduces claim resolution times by up to 40%. - Improved Accuracy & Compliance

Automated compliance tracking lowers the risk of regulatory penalties. - Lower Operational Costs

Automation eliminates redundant tasks, reducing administrative overhead by 30%. - Better Customer Experience

Self-service portals and faster resolutions increase policyholder satisfaction and retention.

- Faster Claims Processing

-

Industry Trends: Why Integration is the Future of Workers’ Compensation

The insurance industry is rapidly adopting integrated technology solutions to enhance efficiency. Key trends include:

1. API-First Platforms: Insurers are shifting towards API-driven ecosystems to ensure seamless data exchange.

2. AI & Predictive Analytics: Advanced claims management platforms use machine learning to detect fraud and optimize claims processing.

3. Cloud-Based Compliance Solutions: More insurers are adopting cloud-based solutions to improve accessibility and security.

A recent study found that 72% of insurers are investing in claims and policy automation to improve efficiency.

Case Study: How Terra Helped an Insurer Transform Operations

Challenge: A regional workers’ comp insurer struggled with slow claims processing and compliance errors due to disconnected systems.

Solution: By implementing Terra’s integrated workers’ compensation platform, they automated claims intake, policy administration, and compliance tracking.

Results:

The Future of Insurance is Integrated

Disconnected systems create inefficiencies that cost insurers time, money, and compliance risks. The solution? A unified platform that integrates claims management, policy administration, and compliance automation into a seamless ecosystem.

Terra’s comprehensive workers’ compensation solution helps insurers modernize their operations, improve claims processing, ensure compliance, and enhance the customer experience—all in a single, API-driven platform.

Ready to Transform Your Insurance Operations?

Take the next step in modernizing your workers’ compensation processes with Terra’s integrated platform.